Ultimate Guide to Cloud-Based Accounting Software for NZ Businesses

Tired of being chained to your office computer just to check your books? Cloud-based accounting software breaks those chains. Instead of being a program stuck on one machine, it's a financial management tool you can access over the internet from anywhere, on any device. This gives you a live, up-to-the-minute view of your business's financial health.

What Is Cloud Accounting Software

Think about the old way of doing things. Your accounting system was like a clunky filing cabinet stuck in the back office. If you needed to find an invoice or update the payroll, you had to be right there. This wasn't just inconvenient; it created bottlenecks and meant decisions were often based on outdated information.

Cloud accounting software flips that model entirely. Picture it as a secure, shared digital vault for all your financial data. Your numbers aren't trapped on a single hard drive anymore. They live safely online, ready for you to access through a web browser or a mobile app whenever you need them.

This isn't just a minor tweak—it fundamentally changes how you manage your finances. Your accounting system goes from being a static record of what's already happened to a dynamic, real-time hub that shows you exactly where your business stands right now. For New Zealand businesses, where being nimble is everything, this shift is a game-changer.

A Financial Hub for Modern Business

Modern cloud platforms have grown into the central nervous system for a company's finances. They connect directly to your business bank accounts, automatically importing transactions. This simple feature saves countless hours of manual data entry and all but eliminates the typos and errors that come with it.

A good cloud accounting system gives you:

Real-Time Data Access: Instantly see your cash position, who owes you money, and where your expenses are tracking, no matter where you are.

Seamless Collaboration: You can give your accountant or bookkeeper secure access to work directly with your live data. No more emailing spreadsheets back and forth.

Powerful Automation: Automate recurring invoices, send out payment reminders without lifting a finger, and create rules that categorise your expenses for you.

Moving to the cloud is more than just a tech upgrade; it’s a strategic business decision. It arms you with the insights needed to make smarter choices, streamlines your day-to-day operations, and builds a more resilient business.

Why It Matters for Kiwi SMEs

For small and medium-sized businesses here in NZ, this technology is a great equaliser. It provides powerful financial tools that were once only available to large corporations, all for a manageable monthly subscription. You get all the benefits without the headaches of maintaining expensive servers or hiring an IT team.

Whether you're a builder sending an invoice from a worksite or a café owner checking the day's takings from your couch, the flexibility is massive.

Ultimately, it's about freeing you up to focus on what you do best—growing your business—instead of getting bogged down in paperwork. Partnering with people who know these systems inside and out, like the Xero-certified team at Simplified Office Systems, ensures you get it right from the start, building a smarter financial foundation for the future.

Key Benefits of Cloud Accounting for Your Business

Moving your accounts to the cloud is about much more than just adopting new tech—it’s about gaining a genuine, measurable edge. For Kiwi SMEs, stepping away from traditional desktop software gives you the clarity, efficiency, and flexibility needed to thrive. It's the difference between driving while looking in the rearview mirror and having a clear view of the road ahead.

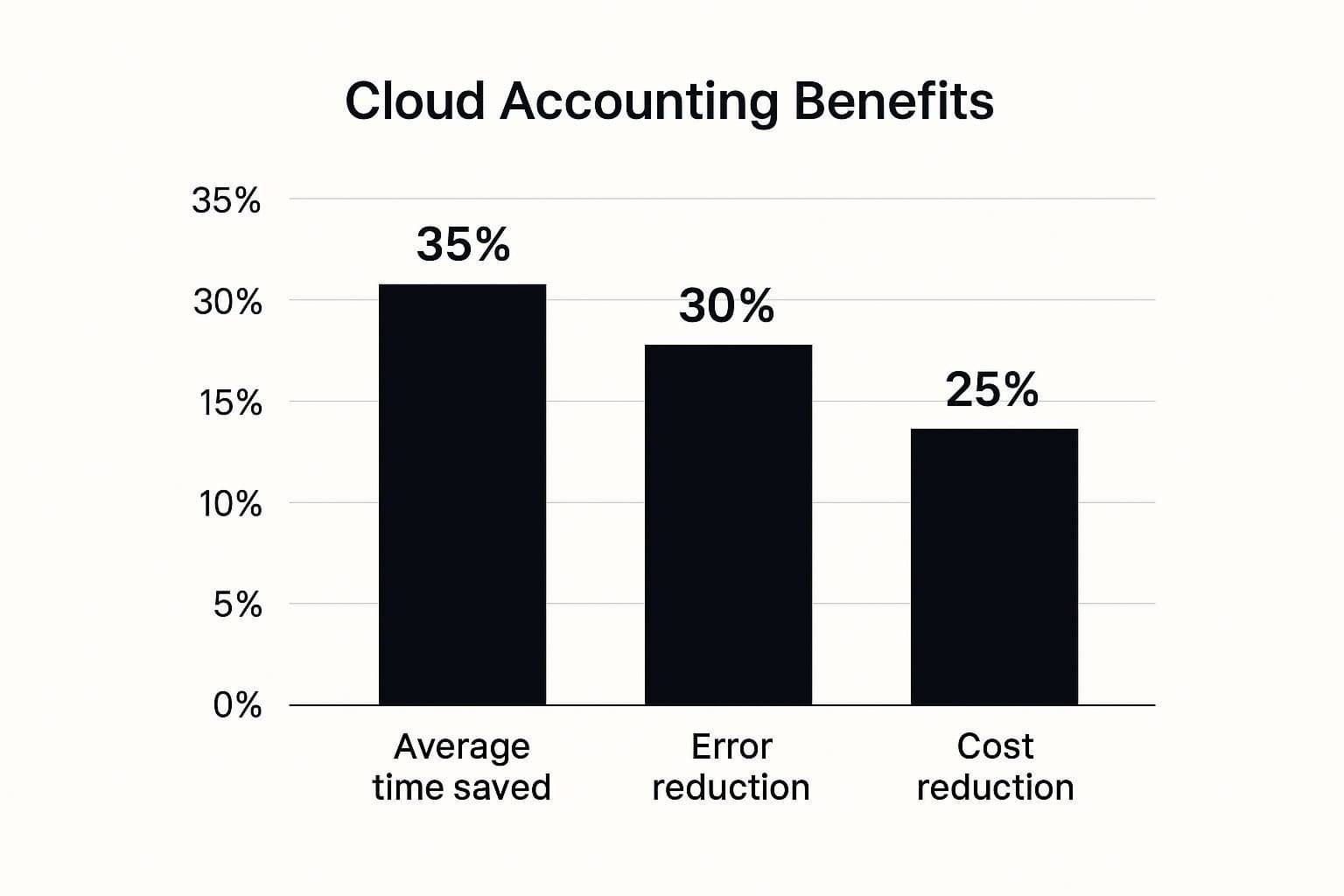

The advantages of cloud-based accounting are immediate and impactful. The chart below gives a snapshot of the average improvements businesses see in time savings, error reduction, and overall costs.

The numbers speak for themselves. Shifting to a cloud platform delivers real returns by cutting down on admin headaches and operational expenses. Let’s break down exactly how these benefits look in the real world.

Gain Complete Financial Visibility Anytime

One of the first things you'll notice is having a live, up-to-the-minute picture of your financial health. With old-school software, your data is often stuck on one computer in the office, making it impossible to check your numbers when you're out and about.

Cloud accounting fixes this by giving you secure access from any device with an internet connection. Picture this: you’re at a supplier's warehouse and spot a great deal on bulk inventory. Instead of guessing if you can afford it, you can pull out your phone, log in, and check your cash flow right there and then.

This real-time visibility empowers you to make smarter, more confident decisions on the spot. You're no longer flying blind or relying on gut feelings; you have hard data at your fingertips.

Enhance Collaboration with Your Team and Accountant

Remember the old dance of finalising your books? You’d email a huge, clunky data file to your accountant, wait for them to work their magic, and then try to patch their version back into yours. It was a recipe for confusion, delays, and errors.

Cloud-based accounting software puts an end to that frustrating cycle. You can give your accountant, bookkeeper, or business partner secure, role-based access to the exact same live data you see.

Collaboration becomes effortless. Your accountant can log in to reconcile bank statements while you're sending out invoices—all happening in the same system, at the same time. This makes month-end and tax time significantly less stressful.

Improve Data Accuracy Through Automation

Manual data entry isn’t just boring; it’s a minefield for costly mistakes. One wrong number can throw off your entire balance sheet, sending you on a wild goose chase for the error.

Modern cloud platforms slash this risk with powerful automation. By connecting directly to your business bank accounts, the software pulls in transactions every day automatically. This feature, known as a bank feed, means no more manually typing in every single deposit and withdrawal.

You can also set up rules to automatically categorise recurring payments. For instance, every payment to your landlord can be coded as 'Rent' without you lifting a finger, saving time and keeping your records consistent.

This automation results in:

Fewer Human Errors: Less manual entry means far fewer typos or miscategorised expenses.

More Timely Data: Your books are always current, giving you a true picture of your financial position.

Increased Productivity: Your team can focus on growing the business instead of getting bogged down in admin.

Stronger Security and Simplified Backups

It’s natural to worry about the security of your financial information. But here's the thing: storing sensitive data on a local computer in your office can be incredibly risky. A crashed hard drive, fire, theft, or malware attack could wipe out your records forever.

Reputable cloud accounting providers invest millions in security measures that are far beyond what a typical small business could manage. Your data is protected by:

End-to-End Encryption: Your information is scrambled and secured both in transit and while it's stored.

Secure Data Centres: Physical servers are kept in highly protected facilities with 24/7 monitoring and security.

Automatic Backups: Your data is backed up constantly, ensuring that even if disaster strikes, your financial history is safe and can be restored.

This robust setup means your information is often far safer in the cloud than on your own machine. The rapid adoption of these platforms across New Zealand proves their reliability. In fact, the local scene is booming, with NZ-founded company Xero reporting a 30% subscriber increase in 2023. This highlights how Kiwi businesses are embracing the cloud for better efficiency. You can explore more about the accounting software market growth for deeper insights.

To really see the difference, it helps to compare the two approaches side-by-side.

Traditional vs Cloud-Based Accounting Software

Feature | Traditional Desktop Software | Cloud-Based Software |

|---|---|---|

Accessibility | Limited to a single, designated computer. No remote access. | Access from anywhere, on any device with an internet connection. |

Upfront Cost | High initial cost for a perpetual software licence. | Low monthly or annual subscription fee. No large upfront investment. |

Collaboration | Difficult. Requires emailing files back and forth, risking errors. | Seamless. Multiple users (e.g., you and your accountant) can work in real-time. |

Data Backup | Manual process. You are responsible for backing up your data. | Automatic and continuous backups to secure, offsite servers. |

Security | Dependent on your local computer's security (firewalls, anti-virus). | Enterprise-grade security with encryption and professional monitoring. |

Updates | Manual updates are required, which can be costly and disruptive. | Updates are automatic and included in the subscription. |

This table clearly shows the practical advantages of a cloud system. It’s a shift from a static, isolated tool to a dynamic, connected platform built for modern business.

How to Choose the Right Accounting Platform

Picking the right cloud-based accounting software is one of the most critical decisions you'll make for your business. It's not about finding the platform with the flashiest features; it's about finding the one that fits your unique operations like a glove. The perfect tool for a local Morrinsville café will almost certainly be a terrible fit for a freelance consultant or a busy tradie.

This choice is the bedrock of your financial management, so it really pays to be methodical. Think of it less like buying a piece of software and more like hiring a key member of your team to handle the money. You need something reliable, that plays well with your other systems, and can grow right alongside your business.

By cutting through the marketing noise and focusing on what you actually need, you can land on a solution that genuinely simplifies your life and adds real value.

Assess Your Business Size and Industry Needs

First things first, take a good, honest look at your own business. A sole trader juggling a handful of clients has completely different needs than a growing retail business with staff and complex stock management.

Start by asking some basic questions. How many transactions are you putting through each month? If the volume is low, a simpler, more affordable plan will probably do the trick. But if you’re processing a high volume, you’ll need a more robust system to avoid sluggish performance or hitting data caps.

Then, drill down into your industry specifics.

For tradies: Do you need features like project tracking and job costing to see which jobs are actually making you money?

For retailers: Does the software need to talk directly to your Point of Sale (POS) system and keep your inventory levels accurate?

For service-based businesses: Is your main priority simple time tracking and firing off professional invoices?

Answering these questions helps you build a shortlist of platforms that are genuinely designed for a business like yours. This initial reality check stops you from paying for a bunch of complicated features you’ll never touch.

Evaluate Scalability and Future Growth

The accounting software you choose today shouldn't become a roadblock tomorrow. Your business is going to change, and your financial system has to be able to keep up. A platform that feels perfect right now could become a major headache in just a couple of years.

Think about your five-year plan. Are you planning on hiring more people? You’ll need a platform with solid payroll features and the ability to add new users without a fuss. Thinking about jumping into e-commerce? Seamless integration with platforms like Shopify is an absolute must.

A truly scalable solution lets you start with a basic plan that covers what you need now, then easily upgrade or add new modules as you grow. This pay-as-you-grow model is one of the best things about cloud software, ensuring you only pay for what you use while keeping your future options wide open.

Check Integration Capabilities

Your accounting software doesn't live on an island. It needs to be the financial hub that connects to all the other tools you rely on to run your business. When systems don't talk to each other, you end up with frustrating data silos and waste hours on manual data entry just to bridge the gaps.

Before you commit, make a list of your essential business apps.

Customer Relationship Management (CRM): Can it sync your customer data to make invoicing a breeze?

Payment Gateways: Does it connect with tools like Stripe or PayPal to automatically reconcile payments?

Inventory Management Systems: Will it update your stock levels in real-time as sales come through?

The goal here is a connected ecosystem where information flows freely. This doesn't just save a massive amount of time; it also makes your data far more accurate by removing the risk of human error. Most software providers list their integrations clearly on their websites, so this is pretty easy to check.

Compare Subscription Models and Budget

Finally, you have to look at the cost. Cloud accounting platforms are usually sold on a subscription, with different tiers offering different features. It’s crucial to look beyond the headline monthly price and really analyse what you're getting for your money.

A cheaper plan might look tempting, but it could be missing a key feature like multi-currency support or automated bank feeds, which will end up costing you more in the long run through manual workarounds. On the flip side, the top-tier plan might be loaded with enterprise-level tools that are complete overkill for your small business.

Your job is to find that sweet spot where the features match your needs and the price fits your budget. Don't forget to factor in potential extra costs for more users, advanced payroll modules, or any special add-ons you might need. A clear budget helps you narrow down the options and make a financially smart decision that will serve you well for years to come.

Making a Smooth Transition to the Cloud

The idea of overhauling your entire financial system can feel pretty overwhelming. But with a solid plan, moving to cloud-based accounting software goes from being a massive headache to a smooth, manageable upgrade for your business.

Get the approach right, and you’ll sidestep the usual chaos and start reaping the rewards almost straight away.

The trick is to break the whole process down into a few clear stages. You wouldn’t build a house without a blueprint, right? It's the same principle here. A little bit of structure ensures your new system is built on a solid foundation, ready to perform from day one and give you a much faster return on your investment.

Strategic Planning and Preparation

Before a single byte of data gets moved, you need to plan. This is the groundwork phase, where you figure out exactly what you need and get all your ducks in a row. Trust me, rushing this part only leads to trouble down the track.

First up, set some clear goals. What are you actually trying to achieve? Maybe you want to slash the time spent on invoicing by 50%, or perhaps the big win is getting a live, real-time picture of your cash flow. Nailing down these objectives gives the entire project direction.

Next, it's time for a bit of a tidy-up. You'll want to gather all your current financial records, making sure everything is clean and up-to-date. This includes:

Your Chart of Accounts: The backbone of your bookkeeping system.

Customer and Supplier Details: Check that all contact info and payment terms are correct.

Outstanding Invoices: A clear list of what you're owed and what you owe.

Bank and Credit Card Statements: You'll need these for reconciling everything later.

Starting with clean, organised data is half the battle won. It makes the actual migration far simpler and much more accurate.

Executing a Flawless Data Migration

With your plan in place, it's time to get your financial history into the new system. This can be the most technical bit of the whole process, and it’s where accuracy is absolutely critical. Bad data in means bad data out, which can completely undermine your new setup.

Most modern cloud platforms like Xero or MYOB have tools to help import data from older software, but it's rarely a simple one-click job. You need to make sure the data is formatted correctly and that everything ends up in the right place.

A common mistake we see is people trying to migrate years and years of messy, archived data. A far better approach is to set a clean "cut-off" date, like the start of your financial year. Just bring over the opening balances and essential current data, and keep the older records archived separately for compliance.

This keeps things simple and gives you a fresh start in a clean, uncluttered system.

Empowering Your Team with Training

The most powerful software in the world is useless if your team doesn't feel confident using it. Proper training is non-negotiable if you want everyone to actually adopt the new system and unlock its full potential.

Don't just send out a new login and hope for the best. Set up dedicated training sessions that are customised for different roles. Your accounts person will need a deep dive into the whole system, but a sales team member might just need to know how to quickly create a quote or lodge an expense claim.

The key is to focus on the practical, day-to-day tasks they'll be doing. Show them how the new software makes their job easier, and you'll get them on board in no time. When people see the direct benefits for themselves, they get excited about the change rather than resisting it.

Understanding Cloud Security and Data Privacy

Let's be honest. Handing over your company's most sensitive financial data to someone else takes a massive amount of trust. For many Kiwi businesses dipping their toes into cloud accounting, the biggest worry isn't about features or cost—it's about security. It just feels safer to have that information sitting on a computer right there in your office.

But here’s the thing: that feeling can be deceptive.

Think of it like storing your cash. You could keep it under the mattress at home. You can see it, you can touch it, but it’s vulnerable. Or, you could put it in a bank vault, protected by guards, cameras, and reinforced steel. That's the difference we're talking about.

Top-tier cloud providers are the digital equivalent of that bank vault. They pour millions into security measures that are simply out of reach for the average small or medium-sized business. This isn't an afterthought; it's the bedrock of their entire operation.

How Your Data Is Kept Safe

When you work with a reputable cloud platform, they aren't just hoping for the best. They build their systems with layer upon layer of defence to shield your financial information from anyone who shouldn't see it.

These aren't just vague promises on a website. They're concrete, verifiable measures that work around the clock.

Key security features typically include:

End-to-End Data Encryption: The moment your information leaves your computer, it's scrambled into unreadable code. It stays that way on their servers, meaning that even if a cybercriminal managed to intercept it, they'd just have a jumble of useless characters.

Secure Data Centres: These are highly-fortified, purpose-built facilities. We're talking 24/7 physical security, backup power systems, and biometric scanners to control who gets in. This prevents anyone from simply walking in and tampering with the hardware that holds your data.

Regular Independent Audits: Good providers pay security experts—professional hackers, essentially—to relentlessly try to break into their systems. These "penetration tests" find and patch up vulnerabilities before bad actors can exploit them.

Together, these measures create a powerful shield around your information. They protect you from online threats and even physical disasters, like a fire or flood that could easily destroy your office computer and all the data on it.

Addressing Privacy and Compliance in New Zealand

Security is about keeping people out. Privacy is about what the provider does with your information on the inside. It’s absolutely vital that your data is handled in a way that respects your confidentiality and complies with New Zealand's laws.

Leading providers are very clear about how they manage your data. You can see our own commitment to this in our privacy policy.

Cloud accounting providers operate under strict data governance policies. Your data remains your property, and they are contractually obligated to protect it. They cannot access or use your financial details without your explicit permission.

Despite all this, security concerns still hold some businesses back. Globally, a study found that around 41% of finance teams are hesitant to move fully to the cloud because of these worries. While adoption in New Zealand is strong, that caution is understandable.

The good news is that the industry is tackling these concerns head-on with ever-improving encryption and airtight data policies, making cloud solutions safer every year. To get a better sense of this, you can dig into more details about the evolving security and growth in the cloud accounting market.

The Future of Accounting in New Zealand

Making the move to cloud-based accounting isn't just about keeping up with the times; it’s about preparing your New Zealand business for what lies ahead. The financial technology space is changing at a breakneck pace, and these platforms are quickly becoming much more than simple bookkeeping tools. They're evolving into smart business advisors.

This shift isn't just a tech upgrade. It positions your business for the future, turning your digital ledger into a powerful foundation for smarter, data-driven decisions.

The Rise of Intelligent Automation

The next wave of innovation, driven by Artificial Intelligence (AI) and machine learning, is already here. Think of your accounting software not just recording what happened last month, but actively helping you predict what will happen next month. That’s fast becoming the new standard.

Here are a few emerging trends that are completely changing the game for financial management:

Predictive Cash Flow Forecasting: AI algorithms can chew through your historical data and current market trends to give you surprisingly accurate predictions of your future cash position. This means you can anticipate shortfalls or plan for expansion with a whole lot more confidence.

Smarter Expense Categorisation: The system learns how you categorise transactions over time. The more you use it, the smarter it gets, eventually cutting down your manual data entry to almost nothing.

Automated Anomaly Detection: Imagine a digital assistant that never sleeps. Your system can automatically flag unusual transactions or potential errors, helping you keep your books clean and catch issues before they become problems.

These aren't just fancy features; they directly link to better business outcomes. They give you the insights you need to be more agile, spot opportunities faster, and get a genuine competitive edge.

A Connected and Growing Ecosystem

Another massive part of this future is the ever-expanding ecosystem of integrated apps. Your accounting platform becomes the central hub of your business, connecting to specialised tools for everything from inventory management and project tracking to customer relationships. This creates a seamless flow of information right across your operation, finally breaking down those frustrating data silos.

Adopting the cloud is not just about modernising your books. It's about building a more intelligent, responsive, and future-proof business ready for the challenges and opportunities ahead.

The momentum behind this change in New Zealand is undeniable. Projections point to strong, continued growth for cloud accounting solutions right through to 2031, as more Kiwi businesses look for ways to scale and enable remote work. The proof is in the numbers: a remarkable 74% of local practices using cloud software saw revenue growth in 2023, with 32% directly tying that success to their tech adoption.

This data paints a clear picture: cloud platforms are a primary driver of financial performance for NZ businesses. You can dive deeper into the New Zealand cloud accounting software market to see the full scope of this trend.

Frequently Asked Questions

Jumping into new technology always sparks a few questions, and when it’s about your business finances, you need answers you can trust. Let's tackle some of the most common queries we hear from Kiwi business owners thinking about making the switch to cloud accounting.

Getting these things straight from the start helps clear up any confusion and gives you the confidence to move forward.

How Secure Is My Financial Data in the Cloud?

This is usually the first question people ask, and for good reason. The truth is, your financial data is almost always safer in the cloud than it is sitting on a computer in your office. Think about it: a laptop can be stolen, a hard drive can fail, or a spilled coffee could wipe everything out.

Top-tier cloud accounting providers invest millions in security that a small business could never afford on its own. They build multiple layers of defence to protect your information.

Bank-Level Encryption: Your data is protected by 256-bit SSL encryption—the same level of security your online banking uses. This makes it completely unreadable to anyone who shouldn't have access.

Secure Data Centres: All your information is stored in high-security facilities that have 24/7 monitoring, backup power, and fortress-like physical access controls.

Multi-Factor Authentication (MFA): This adds an extra layer of security to your login, usually a code sent to your phone, to prove it’s really you.

When you add it all up, your financial records are far better protected from theft, loss, and disaster than they would be on a standard in-house computer system.

Can I Switch from My Current Desktop Software?

Absolutely. Making the move from older desktop programs like MYOB or QuickBooks is a very common process. While it might feel like a big job, modern cloud platforms are built to make this transition as painless as possible, with dedicated tools and step-by-step guides to import your data.

The secret to a smooth changeover is good planning. Before you start, it’s a great idea to clean up your existing records, pick a logical cut-off date (like the start of a new financial year), and follow a clear plan. This makes sure all your customer details, unpaid invoices, and past data come across correctly, setting you up for a fresh start.

Is Cloud Software More Expensive than Desktop Software?

The way you pay is different, and for most businesses, it's much better for your cash flow. Traditional desktop software usually came with a big, one-off price tag, and then you’d have to pay again for major upgrades to get new features or stay compliant with tax laws.

Cloud software, on the other hand, works on a Software as a Service (SaaS) model. You just pay a straightforward monthly or annual subscription fee. This has two huge upsides:

Lower Upfront Cost: You don't have to find a large chunk of cash to get started, which is a massive plus for small business budgets.

Predictable Expenses: You know exactly what your costs will be each month, and that fee includes all the updates, security patches, and maintenance.

Over the long run, this subscription model is often more affordable because there are no surprise bills for upgrades, making your financial planning a whole lot easier.

Ready to make your business finances easier to manage? The Xero-certified team at Simplified Office Systems can help you choose, implement, and master the right cloud accounting platform for your needs. Get in touch with us today to find out how.