Top Tips for Choosing Accounting Software in New Zealand

For so many Kiwi businesses, finding the right accounting software is the moment the lightbulb goes on. It's the key to finally getting financial clarity and unlocking real growth. You're shifting from the old-school, time-sucking way of doing things to a smart, automated system that gives you a live look at your finances and makes tax time a whole lot less stressful.

Why Kiwi Businesses Are Going Digital With Their Books

Let’s be honest, the days of dusty ledgers and a shoebox stuffed with receipts are well and truly behind us. For any modern business owner in New Zealand, trying to manage finances manually is like navigating rush hour in Auckland with a paper map from the 90s. It’s painfully slow, full of wrong turns, and just holds you back.

Moving to digital accounting software isn't just a trend; it's a fundamental upgrade to how you run your business.

Think of it as trading in a massive, clunky filing cabinet for a sleek, secure digital vault. This vault doesn't just sit there—it actively sorts your financial data, making everything accessible whether you're at your desk in Wellington or on a job site in rural Canterbury. This whole shift is happening because business owners need accurate, real-time information to make smart decisions.

The Drive for Better Efficiency

Most business owners are brilliant at what they do, but that doesn't mean they're also bookkeeping experts. Manually punching in numbers is not only boring but also a recipe for costly mistakes that can cause major headaches, especially when the IRD is involved.

Digital platforms take over these repetitive jobs, like:

Bank Reconciliation: Automatically matching up your bank statements with your payments and deposits. No more ticking boxes for hours.

Invoicing: Whipping up and sending out professional-looking invoices in just a few clicks.

Tracking Expenses: Simply snapping a photo of a receipt with your phone to log it, ditching the manual entry for good.

This kind of automation frees up a surprising number of hours every single month. Time you can pour back into what you actually love—running and growing your business.

Keeping Up With New Zealand's Tax Rules

Staying on the right side of New Zealand's tax laws, especially GST reporting, is one of those non-negotiables. The Inland Revenue Department (IRD) has been moving more and more online, pushing businesses to keep digital records and file their returns through digital channels.

The IRD's digital-first approach pretty much makes modern accounting software a must-have if you want to stay compliant and avoid any nasty penalties.

You can see how important these tools have become just by looking at the numbers. New Zealand's accounting services industry is expected to hit NZD 5.1 billion in revenue by 2025, after a solid 2.2% annual growth over the past decade. This growth is all about businesses relying more on smart digital tools to handle their finances. If you're looking to streamline your own operations, you can see how our expert virtual assistants can help at Simplified Office.

At the end of the day, picking the right accounting software in New Zealand is a serious business decision. It's no longer just a nice-to-have tool; it's a core part of staying competitive and building a business that lasts.

Decoding the Must-Have Features of Accounting Software

Choosing the right accounting software for your New Zealand business can feel like you’re trying to learn a new language. But let's cut through the jargon and get straight to the features that will genuinely make your life easier. These aren't just bells and whistles; they're the core functions that will save you time, slash errors, and give you a crystal-clear view of your business's financial health.

Think of these tools less like complicated accounting instruments and more like your trusty sidekick. They handle the mind-numbing, repetitive tasks, freeing you up to focus on what you actually love—whether that's brewing the perfect flat white, managing a construction site, or running a farm.

Automated Bank Reconciliation

Honestly, this is the one feature that makes most business owners breathe a massive sigh of relief. Manually ticking off every single transaction from your bank statement against your own records is a soul-crushing job. It’s slow, tedious, and practically invites mistakes.

Automated bank reconciliation changes everything. The software securely links to your business bank accounts—like your ASB or BNZ—and pulls in a live feed of all your transactions.

The real magic happens next. The software intelligently suggests matches for your invoices and expenses. That payment from 'Smith Electrical'? It instantly lines it up with the invoice you sent them last week. All you have to do is click ‘OK’.

What used to take hours of painstaking work can now be knocked over in a few minutes with your morning coffee. This feature alone ensures your books are always accurate and up-to-date, giving you a real-time picture of your cash flow.

Professional Invoicing and Quoting

The way you bill your clients speaks volumes. A hastily written email or a generic Word template doesn't exactly project a professional image. Modern accounting software gives you everything you need to create and send polished, branded invoices and quotes without any fuss.

Imagine you're a landscaper who has just walked a client through a new garden design. Instead of waiting until you’re back at the office, you can whip up a detailed, professional quote on your phone or tablet and email it to them on the spot.

That kind of speed and polish can make all the difference in winning the job. And once the work is done? You can turn that quote into an invoice with a single click. The system also keeps tabs on which invoices are paid, which are due, and which are getting a bit long in the tooth, making it much easier to chase up late payments.

Simple Expense Tracking and Management

Keeping track of every business expense is non-negotiable for accurate books and making sure you claim everything you're entitled to at tax time. But let's be real—nobody enjoys a glovebox overflowing with faded receipts from Bunnings and Z Energy.

This is where mobile expense tracking comes in. Most modern accounting apps let you manage expenses right from your phone.

Snap and Store: Just take a photo of a receipt. The app uses smart technology (called OCR) to automatically read the key details like the vendor, date, and amount.

Categorise with Ease: You can quickly tag the expense under the right category—'Fuel', 'Materials', 'Office Supplies'—which keeps your accounts tidy.

Ditch the Paperwork: The digital copy is stored securely online, meeting the IRD's record-keeping rules and finally freeing you from that shoebox full of receipts.

Seamless Payroll Integration

If you have a team, payroll is a massive responsibility. Calculating wages, KiwiSaver contributions, and PAYE tax is a minefield of complexity. One wrong move can lead to unhappy staff and some serious headaches with Inland Revenue.

Many of the top accounting platforms in New Zealand either have payroll built-in or connect flawlessly with specialist payroll systems. This integration puts the whole process on autopilot:

Run Your Payroll: The system does all the heavy lifting, calculating wages, deductions, and taxes with precision.

Generate Payslips: It automatically creates and sends professional payslips to your employees.

File with IRD: Crucially, it files all the required payroll information directly with the IRD, keeping you compliant with payday filing obligations.

Simplified GST Reporting

For any GST-registered business in New Zealand, filing your regular return can be a real source of stress. Good accounting software turns this chore into a simple, straightforward task.

Because you’ve been reconciling your bank feed and logging expenses as you go, the software already has all the numbers it needs. When your GST period ends, it automatically calculates the GST you've collected versus the GST you've paid.

It then prepares a GST return that's ready to be filed directly with the IRD, often from right inside the platform. This takes all the guesswork and last-minute panic out of the equation, making tax time just another day at the office.

Unlock Key Benefits for Your New Zealand Business

It’s one thing to read a list of features, but what really matters is how accounting software in New Zealand can genuinely change your business for the better. The question every Kiwi business owner eventually asks is simple: ‘What’s in it for me?’ The answer comes down to three things: control, clarity, and time.

Think of it less as a number-crunching tool and more as a way to fundamentally improve how you run your business. It’s about getting your most valuable asset—your time—back, all while giving you the financial insights you need to grow confidently.

Reclaim Your Time Through Smart Automation

Imagine getting to the end of your week without a mountain of financial admin waiting for you. No more late nights punching in data, chasing down invoices, or fighting with clunky spreadsheets. For most small business owners, this is the single biggest win.

Take a retail owner in Nelson, for example. Before she made the switch, she was losing at least five hours every weekend to sorting receipts and reconciling her bank statements. Now, with automatic bank feeds and expense tracking, the whole process takes her less than 30 minutes a day. That’s almost a full workday she’s gained back every single week to spend on her customers, her stock, and her strategy.

This isn't just about having more free time; it's a genuine competitive edge. It’s time you can pour back into the parts of your business that actually make money.

Boost Your Cash Flow with Better Invoicing

Cash flow is the lifeblood of any Kiwi business. You can be profitable on paper, but if the cash isn't in the bank, you’re in trouble. Good accounting software acts as your cash flow command centre, putting you in the driver’s seat.

One of the most powerful features for this is invoicing. The software turns a tedious chore into a smooth, simple process.

Send invoices instantly from your phone or tablet the second a job is done.

Set up automatic reminders to give clients a friendly nudge when a payment is due.

See a real-time dashboard of what’s outstanding, so you always know who owes you money.

For a tradesperson in Hamilton, this means getting paid in days, not weeks. That quick turnaround gives him the stability to pay his own suppliers on time and invest in new gear without the usual stress.

By maintaining a clear and consistent invoicing process, you not only improve your financial health but also project a professional image that builds client trust and encourages prompt payment.

Make Smarter Decisions with Instant Reports

Running a business on guesswork is a risky game. To make smart, strategic calls, you need accurate, up-to-the-minute financial data at your fingertips. This is where reporting features really prove their worth.

With just a couple of clicks, you can pull reports that give you a crystal-clear snapshot of your business's health:

Profit & Loss Statement: See exactly where your money is coming from and where it’s going.

Balance Sheet: Get a handle on your assets, liabilities, and overall financial standing.

Cash Flow Summary: Track how cash is moving through your business over any given period.

This data helps you spot trends, figure out which services are your most profitable, and catch small problems before they become big ones. You can finally stop reacting to financial surprises and start proactively planning for growth.

Achieve Peace of Mind with Simplified Compliance

Let’s be honest, nothing beats the feeling of knowing your tax and compliance obligations are sorted. Good accounting software for New Zealand is built from the ground up to work seamlessly with Inland Revenue (IRD) requirements.

It makes GST calculations and filing your returns a simple, straightforward task. By keeping a perfect digital record of every transaction, it also ensures you’re always ready for a potential audit. A key part of this is getting your invoicing right, which you can learn more about in our complete guide to NZ tax invoice requirements.

Ultimately, this doesn't just save you from headaches and potential penalties—it removes the stress that tax time brings for so many business owners.

How to Choose the Right Accounting Software in NZ

Picking the right accounting software can feel like a huge commitment, and frankly, it is. The platform you choose will become the financial engine of your business, so it’s something you really want to get right from the start.

This isn’t about finding a magic "one-size-fits-all" solution. The goal is to find the perfect fit for your business, right here in New Zealand. A sole trader's needs are worlds apart from a growing company hiring its first few employees. Let’s walk through a clear framework to help you make a smart, confident choice.

First Things First: Assess Your Business Needs

Before you even start looking at shiny software features, take a good, hard look at your own operations. What do you actually need today, and what’s on the horizon for the next year or two? Jumping this step is like buying a massive ute when all you really need is a small, zippy van—it might get the job done, but it’s far from efficient.

Start by asking some basic but crucial questions:

What’s your business structure? Are you a sole trader, a partnership, or a company? Your answer dictates your tax and reporting obligations.

Who’s on the team? Is it just you, or do you have staff to pay? If you have employees, a solid payroll function is non-negotiable.

How busy are you? Think about how many sales invoices and purchase bills you handle each month. High volume means you’ll want powerful automation.

What industry are you in? A retailer managing complex stock has very different needs from a tradie who needs to track time and materials for specific jobs.

Getting a handle on these points gives you a clear checklist of the core features you can't live without. This foundation makes comparing different accounting software for New Zealand businesses a whole lot simpler.

Look Ahead: Prioritise Scalability for Future Growth

The software that’s perfect for your startup today might feel cramped and restrictive in three years. As your business grows (and you hope it will!), your accounting platform must be able to keep up. A system that can’t scale will create massive administrative headaches, eventually forcing you into a difficult and expensive switch.

Think of it this way: you’re not just buying a tool for today; you're investing in a partner for your future ambitions. You might not have employees right now, but if hiring is in your five-year plan, you’ll want a platform that offers a seamless payroll add-on when the time comes.

Don’t just choose a solution for the business you have today; choose one for the business you want to become. This foresight prevents you from outgrowing your software and having to start this entire process over again.

Make Sure It’s a True Kiwi Fit: Local Support and Integrations

While many software brands are global giants, having strong local roots in New Zealand is a massive advantage. This really comes down to two things: getting help when you need it and making sure it connects with other Kiwi systems.

When you hit a snag with GST or PAYE at 8 AM on a Tuesday, you want to talk to someone who knows what you’re talking about, not a support agent on the other side of the world. Check what kind of local support is on offer—can you get someone on the phone, or is it just email and live chat?

Just as important are the integrations. Your accounting software must play nicely with:

NZ Banks: Smooth, automatic bank feeds from institutions like ASB, BNZ, and Westpac are essential for easy reconciliations.

Inland Revenue (IRD): The ability to file GST returns and manage payday filing directly from the software will save you an incredible amount of time and hassle.

This local focus is a huge part of the digital shift happening across the country. As more small businesses modernise their finances, the demand for locally-tuned systems has soared. In fact, around 86% of accounting firms in New Zealand have already adopted cloud solutions, showing just how fast things are moving on from old-school spreadsheets. You can find more details on these industry trends and how they impact local businesses.

Don't Overlook the Obvious: Is It Easy to Use?

Finally, never underestimate the power of a clean, intuitive design. The best accounting software in the world is useless if you and your team can't stand using it. If a platform is clunky, confusing, or just plain frustrating to navigate, it will create more problems than it solves.

Almost every top provider offers a free trial. Use it! Get in there and get your hands dirty. Try to create an invoice, run a simple report, and reconcile a few bank transactions. If you find yourself pulling your hair out during the trial, it’s a sure sign that it won’t get any better once you’ve paid for it.

Software Selection Checklist for NZ Businesses

To help you put all this into practice, here's a simple checklist. Use these questions as a guide when you’re comparing different software options to make sure you cover all your bases.

Consideration | Question to Ask | Why It Matters |

|---|---|---|

Core Features | Does it handle invoicing, expense tracking, and GST returns easily? | These are the absolute basics. If it can't do these well, it's not the right tool. |

Payroll Needs | If I have staff (or plan to), does it offer integrated, IRD-compliant payroll? | Payroll is complex in NZ. An integrated system simplifies payday filing and reduces errors. |

Bank Feeds | Does it connect reliably with my New Zealand business bank account? | Automatic bank feeds are the biggest time-saver in modern accounting. This is a must-have. |

Scalability | Can I easily add more users, features, or integrations as my business grows? | You want a platform that grows with you, not one you'll outgrow in a year or two. |

Ease of Use | Is the interface clean and intuitive? Can I find what I need without a manual? | If it's not user-friendly, you won't use it to its full potential, wasting your investment. |

NZ Support | Is there local, knowledgeable customer support available during NZ business hours? | Getting timely help from someone who understands local tax rules is invaluable. |

Pricing | Is the pricing model clear and does it fit my budget? Are there hidden costs? | Understand the total cost, including any add-ons you'll need, to avoid surprises. |

Industry-Specifics | Does it have features for my industry, like project tracking, inventory, or job costing? | Niche features can make a huge difference in efficiency for specific types of businesses. |

Choosing the right software is a big decision, but it doesn't have to be overwhelming. By systematically working through these points, you can move past the marketing hype and find a tool that genuinely supports your business and helps it thrive.

Comparing New Zealand’s Leading Accounting Software

Once you’ve mapped out what your business actually needs, it’s time to look at the main players in the accounting software in New Zealand scene. It's a busy market, but a few platforms have consistently earned the trust of thousands of Kiwi businesses. The goal isn't to find the one "best" software, but to find the one that fits your business like a glove—your specific industry, your size, and where you plan to go next.

Let's cut to the chase. For most small and medium-sized businesses in New Zealand, the conversation usually starts with two homegrown heavyweights: Xero and MYOB. While they both cover the essentials, their philosophies, how they feel to use, and the type of business they suit best are quite different.

H3: Xero: The Cloud-Native Champion

Born and bred right here in New Zealand, Xero is famous for its clean, intuitive design. It was built for the cloud from the get-go, and you can feel that user-friendly approach in every click. For a lot of startups, sole traders, and business owners who aren't accountants by trade, Xero just makes sense.

Its real magic lies in its simplicity and smart automation. Things like matching bank transactions and connecting to a massive library of other business apps are where it truly shines.

Best For: Startups, sole traders, and small businesses who value ease of use and a modern, uncluttered interface above all else.

Standout NZ Feature: Flawless integration with every major New Zealand bank and a direct, seamless link to the IRD for GST and payday filing.

Key Takeaway: If you want a system that just works without a lot of fuss and has brilliant automation, Xero is a very tough act to follow.

The platform’s growth has been phenomenal, and it’s a story rooted in making cloud accounting accessible. Xero has expanded well beyond our shores, reporting revenues of NZD $1.7 billion in the 2024 financial year. That growth is powered by a continuous rise in global subscriptions, showing just how much platforms like Xero have changed the game. For more on this trend, check out these insights into the accounting software market's growth.

H3: MYOB: The Established Powerhouse

MYOB has been a fixture in the New Zealand and Australian business landscape for decades. It might have started out as desktop software, but its modern cloud versions are powerful and packed with features, often making them the preferred choice for more established or complex businesses.

Where MYOB often pulls ahead is in its granular control and deeper functionality, especially in areas like inventory management, detailed job costing, and tricky payroll situations. This has made it a long-time favourite for businesses in construction, manufacturing, and wholesale distribution.

Best For: Established SMEs, companies with complex inventory or job tracking needs, and anyone who needs more detailed, customisable reporting.

Standout NZ Feature: Advanced payroll and inventory management tools that are specifically tuned for local business rules and regulations.

Key Takeaway: If your business has operational needs that go beyond the basics, MYOB's depth of features is hard to beat.

High-Level Comparison of Popular NZ Accounting Software

To give you a quick snapshot, here’s how the leading platforms stack up at a glance. Think of this as a starting point to help you narrow down your search based on what matters most to your business right now.

Software | Best For | Key NZ Feature |

|---|---|---|

Xero | Startups, sole traders, and businesses prioritising ease-of-use. | Seamless bank feeds and direct IRD integration for GST. |

MYOB | Established businesses with complex inventory or job costing needs. | Advanced, highly configurable payroll and inventory systems. |

QuickBooks | Mobile-first businesses and those seeking a strong global alternative. | Excellent mobile app and user-friendly, all-round features. |

Infusion | Trades, retail, and wholesale needing an all-in-one system. | Integrated accounting, job management, and ERP capabilities. |

Ultimately, the best choice is the one that solves your biggest headaches. A beautiful interface is great, but not if it’s missing the one specific inventory feature your retail store desperately needs.

H3: Other Strong Contenders to Consider

While Xero and MYOB get most of the attention, they’re not your only options. A few other fantastic platforms have carved out their own space in the market.

QuickBooks Online is a global giant with a solid footprint in New Zealand. It's known for its slick interface and a really powerful mobile app, which is a huge plus for business owners who are always on the go. Its feature set is right up there with the leaders, making it a brilliant all-round alternative.

You might also come across Infusion Software, especially if you're in the trades, retail, or wholesale sectors. This is a more specialised, Kiwi-owned solution that blends accounting with serious ERP (Enterprise Resource Planning) power. Think advanced inventory, job management, and point-of-sale systems all rolled into one. It’s built for businesses that have outgrown the simpler packages and need one system to run everything.

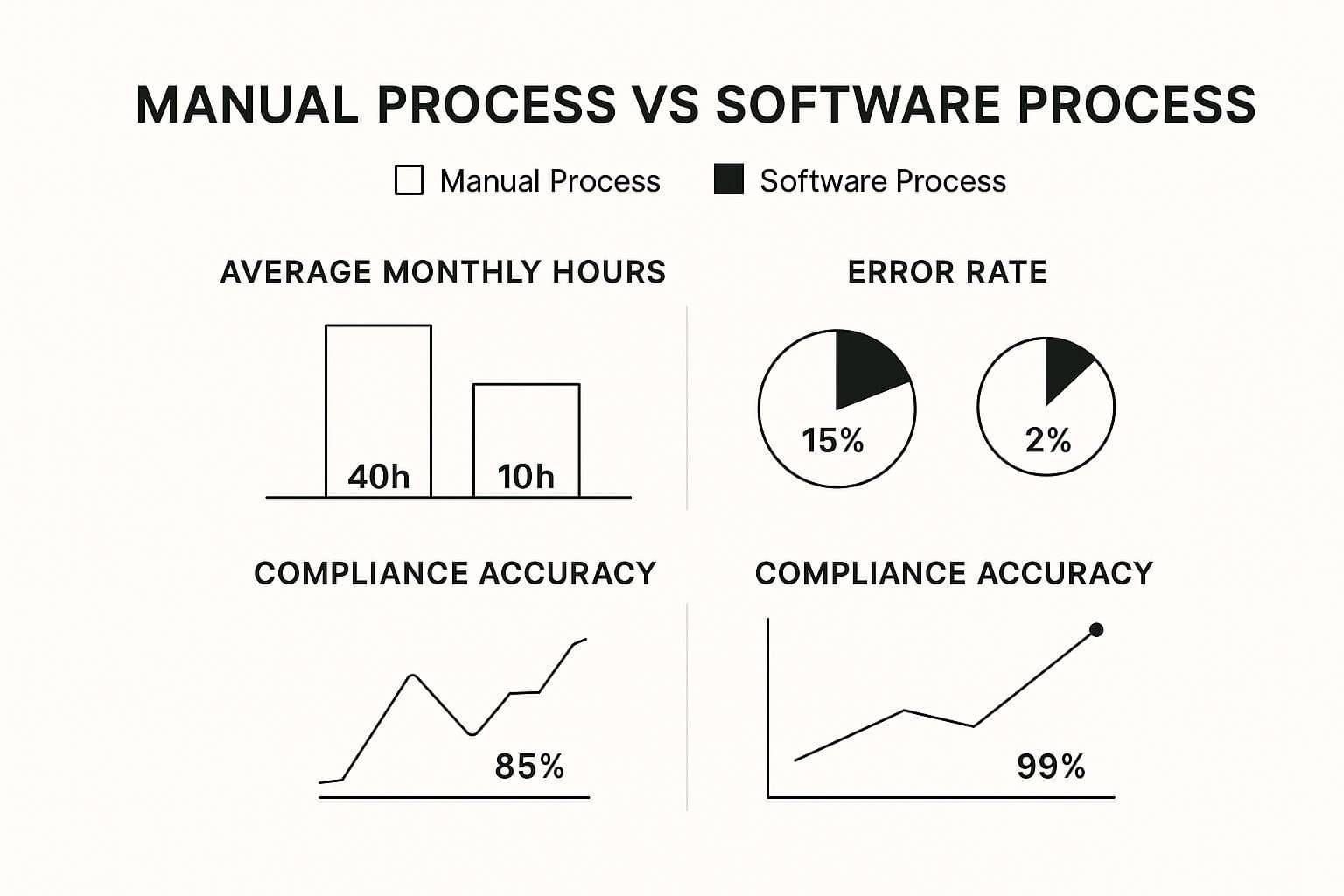

The image below really drives home the efficiency boost businesses get when they switch from spreadsheets and shoeboxes to proper accounting software.

As you can see, making the move drastically slashes the time spent on admin while improving accuracy. It’s not just about saving time; it's about freeing you up to focus on growing your business.

Your Questions About Accounting Software Answered

Taking the leap into dedicated accounting software is a big step. It’s completely normal to have a few questions rattling around in your head. You’re not just buying a subscription; you’re changing the way you manage the financial heart of your business.

Let's clear up some of the most common uncertainties we hear from Kiwi business owners. The goal here is to give you direct, practical answers so you can move forward feeling confident, not confused.

Do I Still Need an Accountant if I Use This Software?

This is easily the most common question we get, and the answer is a definite yes.

Thinking that accounting software replaces your accountant is like believing a top-of-the-line oven makes you a Michelin-star chef. The oven is a brilliant tool, but you still need an expert to create the masterpiece.

Your software is fantastic at handling the day-to-day grind. It automates invoices, tracks expenses, and reconciles your bank accounts with incredible speed. This is the essential groundwork. Your accountant, however, provides the high-level strategy and expertise that software simply can't.

Strategic Advice: They interpret the financial reports your software generates, helping you see the bigger picture. They’re trained to spot opportunities, identify potential risks, and guide your business growth.

Tax Planning: A good accountant doesn’t just file your taxes; they help you plan for them. They understand the ins and outs of New Zealand tax law and can structure your finances in the most tax-efficient way possible.

Complex Issues: When you face big financial decisions—like securing a loan, investing in new equipment, or planning an exit strategy—your accountant is your most valuable advisor.

The real power comes when you combine both. Your software provides clean, accurate, real-time data, which lets your accountant spend less time on basic compliance and more time offering high-value advice that truly helps your business thrive.

What Is the Typical Cost for a Small Kiwi Business?

The cost of accounting software in New Zealand isn't as scary as you might think. For most small businesses, it's a manageable monthly expense, with most platforms operating on a subscription model.

The price you pay usually comes down to the features you need. A sole trader who just needs to send a few invoices a month will pay a lot less than a growing company with multiple staff needing payroll and inventory management.

Here’s a rough guide to what you can expect:

Basic Plans: These often start around $30 - $40 per month. They're perfect for sole traders and freelancers, covering the essentials like invoicing, expense tracking, and basic reports.

Standard Plans: Ranging from $60 - $80 per month, these are the sweet spot for most small businesses. They typically add features like payroll for a few employees and more detailed reporting.

Premium Plans: For larger or more complex businesses, plans can go upwards of $90 per month. These pack in advanced features like multi-currency support, project costing, and full-blown inventory systems.

Try to see this as an investment, not just a cost. The time you’ll save on manual admin and the financial clarity you gain will almost always deliver a return that far outweighs the monthly fee.

How Hard Is It to Move from Spreadsheets?

I get it. The thought of moving years of financial data from familiar spreadsheets into a completely new system can be daunting. You worry about a steep learning curve and the potential for things to go wrong.

The good news? Modern accounting software is designed specifically to make this transition as smooth as possible. These platforms are built for business owners, not just accountants, so they focus on user-friendly dashboards and guided setup processes.

Making the switch is usually a pretty straightforward process:

Choose Your Start Date: It's often easiest to make a clean break at the beginning of a new financial year or a new GST period.

Import Your Data: Most systems let you easily import customer lists, supplier details, and your chart of accounts straight from a spreadsheet file.

Connect Your Bank: Securely linking your business bank account is a simple, one-time task. This is what sets up the automatic bank feeds, which is where the real magic happens.

Get Some Training: Take advantage of the free webinars, video tutorials, and help articles. Most people find they can get the hang of the basics in just a few hours.

While it takes a little effort upfront, the long-term benefits are huge. Within a few weeks, you'll be wondering how you ever managed without it. For more insights and tips on optimising your business operations, you can explore our other articles on the Simplified Office blog.

If you're ready to gain control over your business finances but need a hand with the setup or ongoing bookkeeping, Simplified Office Systems is here to help. Our Xero-certified team can manage your accounts, payroll, and bookkeeping, letting you focus on what you do best. Contact us today to learn how we can make your business life easier.