NZ Tax Invoice Requirements NZ: Your Complete Guide

If you're running a GST-registered business in New Zealand, getting your tax invoices right isn't just good practice—it's a legal must-do. This isn't just about asking for payment; it's the official record of a sale, containing all the details both your customer and Inland Revenue (IRD) need to track Goods and Services Tax.

Think of a proper tax invoice as the key that unlocks GST claims. Without it, your business customers can't claim back the GST they've paid, and your own records won't pass muster.

Understanding Your Core Tax Invoice Obligations

For any Kiwi business registered for GST, a tax invoice is a critical legal document. It's the official proof of a transaction that allows another GST-registered business to claim an input tax credit. If that invoice is missing key information, their claim could be held up or even denied by the IRD. Getting this right is fundamental to maintaining good business relationships and staying compliant.

Let's say you're a plumber and you buy a new set of tools from a hardware supplier. The tax invoice they give you is your proof that you paid GST. It's the document you'll use to claim that GST back in your next return. If it’s not a valid tax invoice, you've got a problem. This simple principle applies to every GST-registered business, whether you're a consultant, a cafe owner, or a farmer.

When You Must Provide a Tax Invoice

So, do you need to issue a full tax invoice for every single sale? Not necessarily. The rules are pretty practical.

You're legally required to provide a tax invoice when:

The total sale is more than NZD $50 (including GST).

A customer asks for one, even if the sale is under $50. If they're GST-registered, they'll need it for their records, and you have to supply it.

You must provide the invoice within 28 days of making the sale or receiving the customer's request. Don't leave them waiting.

A tax invoice is the single source of truth for GST. It substantiates claims and creates a clear, auditable trail for every taxable transaction, protecting both the buyer and the seller.

Falling short on these basic duties can cause real headaches. For your customer, it means they can't claim their GST, which affects their cash flow. For you, it looks unprofessional and could attract unwanted attention from the IRD if it becomes a habit. Nailing these fundamentals from day one just makes business run a whole lot smoother.

The Anatomy of a Compliant Tax Invoice

Think of a tax invoice like a formal receipt for the IRD. If you get it wrong, it can cause headaches for both you and your customer when it's time to claim GST. Getting the details right isn't just about good bookkeeping; it's a legal requirement that ensures every transaction is transparent and properly recorded.

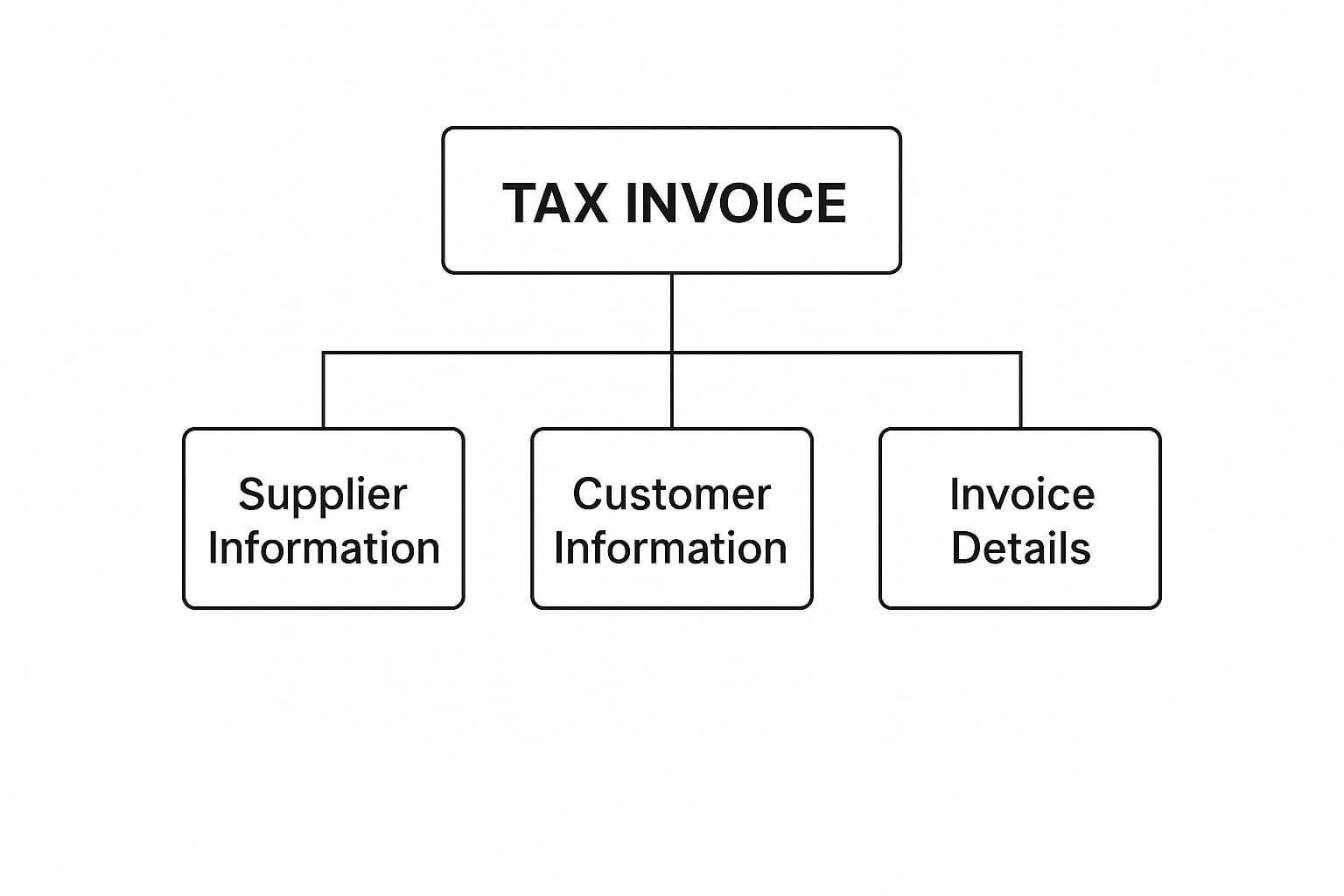

At its heart, a tax invoice tells a simple story: who sold what to whom, and for how much. It breaks down into three key parts: your details as the supplier, your customer's details, and the specifics of the sale. Each piece is crucial for creating a valid document that the IRD will accept.

This diagram gives a great visual breakdown of how these components fit together.

As you can see, it's a straightforward structure. Getting these foundational pillars right ensures every sale is clear, traceable, and ready for your next GST return.

Core Invoice Components

No matter the size of the sale, there are a few non-negotiable details that absolutely must be on every tax invoice you issue. Think of these as the bare minimum for your document to be considered legitimate by Inland Revenue.

Here’s the essential checklist for any tax invoice:

The words "Tax Invoice" need to be clearly visible, usually at the top.

Your business name and GST number.

The date the invoice is created.

A brief but clear description of what you sold.

The total amount payable, including the GST.

If any of these are missing, the IRD might reject the invoice. That can create a real mess for your customer trying to claim a GST credit and complicate your own records. It’s a simple checklist, but a vital one.

How Requirements Change with Value

The IRD doesn't expect the same level of detail for a $60 sale as it does for a $6,000 one. The rules scale with the value of the transaction. For small purchases, the requirements are pretty relaxed, but as the dollar amount climbs, you need to provide more information.

In New Zealand, you generally need to provide a tax invoice for any sale over $50 if the customer asks for one. For any supply over $200, you must issue one within 28 days of being asked. The rules get even stricter once the sale hits $1,000 or more, which is when you need to add details like your customer's name and address and show the GST component clearly. For a deeper dive, it's worth exploring the official IRD invoicing rules to get familiar with all the thresholds.

Here's a quick look at how the invoice requirements change based on the total sale price.

NZ Tax Invoice Requirements by Transaction Value

This table breaks down the key differences, helping you see at a glance what information you need to include depending on the total sale amount.

Information Required | Sales Under $1,000 | Sales $1,000 and Over |

|---|---|---|

The words "Tax Invoice" | Required | Required |

Supplier's Name and GST Number | Required | Required |

Date of Issue | Required | Required |

Description of Goods/Services | Required | Required |

Total Amount Payable | Required | Required |

Recipient's Name and Address | Not Required | Required |

GST Amount or Statement | Not Required | Required |

This tiered system is designed to keep things simple for everyday transactions while making sure larger sales have the detailed paper trail the IRD needs. It’s a good habit to always double-check the total value before you finalise and send an invoice.

Navigating the Shift to Taxable Supply Information

The world of GST compliance in New Zealand is always evolving. A pretty significant change came into play on 1 April 2023, when the rules shifted away from the old-school ‘tax invoice’ to the more modern concept of ‘taxable supply information’. This wasn't just for the sake of it; the update was designed to make life easier for businesses and finally catch up with technology. You can read up on the finer points of these GST invoicing requirement changes if you want to dive deeper.

But this is more than just a name change. It’s a real shift in how we’re expected to record and share transaction details. Think of it less like a completely new rulebook and more like a software update for the digital age. The crucial information you need to record for GST hasn't changed, but how you provide it is now far more flexible.

This new approach finally acknowledges what we all know: business is done online, through apps, and with all sorts of software. The strict format of a paper or PDF invoice is no longer the only game in town when it comes to meeting your tax obligations in NZ.

What This Change Means for You

The big takeaway here is flexibility. Instead of being stuck with one specific document format, you can now provide the necessary information in whatever way makes sense for your business. This opens the door to more efficient, tech-friendly solutions that can seriously cut down on your admin time.

For instance, this change paves the way for the wider use of e-invoicing, where data shoots directly from your accounting system to your customer's, no manual data entry required. It also means the details you provide in an online customer portal or on a digital receipt can be fully compliant, as long as all the required information is there.

The move to taxable supply information is about separating the what from the how. The essential data needed for GST remains unchanged, but the methods of delivery have been modernised to fit how businesses operate today.

The whole point is to reduce the hassle and paperwork that comes with GST. By allowing for different ways to keep records, the system is now a much better fit for modern business, whether you're running an e-commerce store or a service company using specialised software.

The Core Information Is Still King

Even with all this new-found flexibility, the essential details for a valid GST record are still non-negotiable. You absolutely must provide and keep a clear record of the transaction. The information you need to capture largely mirrors what was on a traditional tax invoice, which makes sense—it keeps the integrity of the whole GST system intact.

Here’s what you must record:

Your business name and GST number.

The date the goods or services were supplied (or the date you provide the information).

A clear description of what you sold.

The total price and a statement that it includes GST.

For any transaction over $1,000, you’ll also need to include the recipient's name and address. So, while the "box" the information comes in has changed, the "stuff" inside that box remains just as important for accurate tax reporting. This ensures every business can still claim their GST credits with confidence.

Embracing E-Invoicing for Business Efficiency

While most of us are used to paper or PDF invoices, there’s a much smarter way to manage your billing that's quickly becoming the new standard. E-invoicing is a major step up, moving us away from simple digital files and into a system where invoice information travels directly from your accounting software straight into your customer's.

Think about it. You send an invoice, and it instantly shows up in your client’s system, correct and ready for approval. No one has to lift a finger to type in dates, amounts, or invoice numbers. That's the magic of e-invoicing. It’s not just a PDF you email; it's structured data that computers can read and handle all by themselves.

This automation is a huge deal, which is why the New Zealand government is so keen for businesses to get on board. When you remove manual data entry, you slash the risk of human error—the kind of small mistakes that cause payment delays and frustrating back-and-forth conversations. It also saves a heap of time and money on admin tasks like printing, postage, and chasing up invoices that got lost in an inbox.

The Government's Push and Your Advantage

The move to e-invoicing is getting more official. It's still voluntary for most businesses right now, but government agencies are taking the lead to show everyone how well it works. This really sets the stage for where business transactions are heading in New Zealand.

In fact, e-invoicing is becoming the benchmark for how modern tax invoices should work. By January 2026, many key government departments will be required to handle e-invoices, both for sending and receiving them. This sets a new expectation for anyone who supplies to them. You can learn more about New Zealand's e-invoicing rules and benefits on Stripe.com.

Jumping on the e-invoicing train isn't just about following government trends; it’s a smart move for your own bottom line. The advantages are pretty clear:

Faster Payments: Because they're processed quicker and have fewer errors, e-invoices tend to get paid faster. This can make a real difference to your cash flow.

Lower Costs: You'll save money on the obvious things like paper and printing, but also on the staff time spent on manual invoice wrangling.

Enhanced Security: E-invoices are sent over a secure network, which cuts down the risk of fake invoice scams and email fraud.

Think of e-invoicing not as a compliance headache, but as a direct upgrade to your financial workflow. It’s all about getting paid faster, with less fuss and better accuracy.

What’s more, New Zealand’s e-invoicing system is built on the same international Peppol network that Australia uses. This makes trans-Tasman business much simpler and more streamlined. By adopting e-invoicing now, you’re not just optimising your current operations—you're setting your business up for smoother, faster growth in the future.

Common Invoicing Mistakes and How to Avoid Them

Even with the best of intentions, mistakes happen. A tiny error on an invoice might seem like no big deal, but it can quickly spiral into delayed payments, rejected GST claims for your customers, and even a headache with Inland Revenue.

Getting your invoicing process right isn't just about ticking boxes; it's about keeping your cash flow healthy and your business relationships strong. Think of it as a final quality check before your work goes out the door. Catching a small slip-up at this stage saves everyone a mountain of hassle later.

Let's walk through some of the most common invoicing blunders I see and, more importantly, how to sidestep them for good.

The Missing GST Number

It's such a simple thing, but you’d be surprised how often a GST number gets left off an invoice. When that happens, the document is instantly invalid as a tax invoice.

For your GST-registered customers, this is a real problem. They can't legally claim back the GST on their purchase without your number, which means you’ll be getting an email or a phone call asking for a corrected version. It’s an unnecessary delay for everyone involved.

How to Fix It: The easiest solution is to set it and forget it. Add your GST number to your master invoice template. Whether you're using accounting software like Xero or a simple Word document, make it a permanent, non-negotiable part of the design. Pop it somewhere obvious, like in your header or footer, so it shows up every single time.

Incorrect GST Calculations

Doing the maths manually is just asking for trouble. A simple slip of the finger on a calculator can mean you're either overcharging or undercharging the 15% GST.

Both scenarios create a messy paper trail. You'll have to issue a credit note to cancel the wrong invoice, then create and send a brand new one. It's a waste of time that undermines the professional look you're going for.

A tax invoice is a legal document, and its numbers must be perfect. An incorrect GST calculation invalidates the entire document for tax claim purposes, turning a simple transaction into an administrative burden.

How to Fix It: Take the human element out of the equation. This is where accounting software really shines. It's programmed to calculate GST perfectly every time, ensuring your invoices meet tax invoice requirements NZ without you ever having to worry about the maths.

Failing to Keep Records for Seven Years

Sending a perfect invoice is only half the job. In New Zealand, the IRD requires you to hold onto all your business records—including the tax invoices you send and receive—for a minimum of seven years.

If you can't produce those records during an audit, you could be in hot water. Without that proof, it becomes incredibly difficult to verify your income and expenses, potentially leading to some serious penalties.

How to Fix It: Go digital and get a backup. Cloud-based accounting platforms are brilliant for this, as they store everything securely for you. If you’re still managing invoices manually, get into the habit of scanning every document and creating a logical digital filing system. And please, back it all up! A separate cloud drive or an external hard drive gives you that extra peace of mind.

Got Questions About NZ Tax Invoices? We've Got Answers

Getting your head around GST rules can feel a bit like navigating a maze. But when you boil it down, most of the confusion comes from a handful of common questions. This section is all about clearing the air and giving you straight, simple answers to the things business owners ask most.

Think of this as your go-to cheat sheet for handling those practical, day-to-day invoicing puzzles with confidence.

Does My GST Number Have to Be on Every Invoice?

In short, yes. If you’re GST-registered, your GST number absolutely must be on any tax invoice for a sale over NZD $50. There’s no wiggle room here; it’s a core requirement for a valid tax invoice.

Without it, your customer can't claim the GST back on their purchase, which can cause real headaches for them. The IRD checks for this, so save everyone the trouble and make sure it’s a permanent fixture on your invoice template.

What if an Invoice Doesn't Say 'Tax Invoice'?

If you’re handed an invoice for more than NZD $50 and it’s missing the words 'Tax Invoice', then from the IRD's perspective, it’s not a valid tax invoice. The same goes for credit or debit notes – they need to be clearly labelled 'Credit Note' or 'Debit Note'.

Your best move is to contact the supplier right away and ask for a corrected version. It might seem like a tiny detail, but without that specific wording, you can't legally claim the GST on that expense.

A document that fails to identify itself as a 'Tax Invoice' is essentially just a bill. For GST purposes, this distinction is critical—only a valid tax invoice unlocks the ability to claim input tax credits.

This rule is a cornerstone of the tax invoice requirements NZ framework. It’s all about creating a crystal-clear paper trail that leaves no room for doubt.

How Long Do I Need to Keep Copies of Tax Invoices?

New Zealand law is very clear on this: you must hang on to all your business records, including the tax invoices you send and receive, for at least seven years.

It’s perfectly fine to keep them digitally—in fact, it's often much easier—as long as the files are secure, complete, and you can get to them easily. If the IRD comes knocking for a review, you’ll need to pull them up without delay. This is where cloud accounting software really shines, as it handles all that storage for you automatically.

Is Sending a PDF Invoice by Email Okay?

Absolutely. Attaching a PDF tax invoice to an email is a completely legitimate and standard way to bill your customers. The IRD is perfectly happy with this method.

The key thing is that the PDF document itself contains all the required information we've discussed. While it’s not the same as true e-invoicing (where data zips directly between accounting systems), a PDF sent via email is still a valid and compliant way to get the job done.

Feeling bogged down by admin like invoicing, payroll, and bookkeeping? Let Simplified Office Systems build you effective office systems so you can get back to doing what you love. Visit us at https://www.simplifiedoffice.co.nz to see how we can make your business life a whole lot easier.